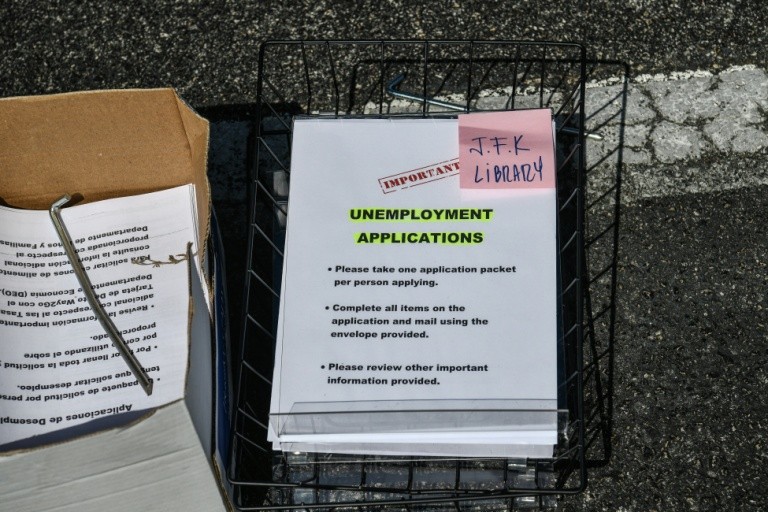

US unemployment is rising at a jarring rate, with data released Thursday showing 17 million people have lost their jobs since mid-March as officials scramble to apply a tourniquet to stem the damage from the coronavirus pandemic.

The Federal Reserve launched a series of new lending programs Thursday to pump $2.3 trillion into the damaged US economy, but Fed Chair Jerome Powell tried to offer reassurance, saying the recovery could be “robust.”

The Fed’s announcement came at the same time as the Labor Department’s latest weekly report showed 6.6 million more people filed for unemployment benefits last week, following 6.9 million in the prior week and 3.3 million in the week ended March 21.

That is a stunning reversal for the world’s largest economy where the jobless rate was near historic lows before it was forced to shut down to stop the spread of COVID-19.

Analysts expect the malaise to persist for months, with the jobless rate surging into double digits in April, as President Donald Trump eyes getting the country back in business.

Treasury Secretary Steven Mnuchin meanwhile gave a more definitive timeframe, saying on CNBC businesses could restart as soon as May.

“As soon as the President feels comfortable with the medical issues, we are (doing) everything necessary (so) that American companies and American workers can be open for business and that they have the liquidity that they need to operate their businesses in the interim,” he said.

The unemployment data indicate the coronavirus pandemic is set to eclipse job losses from the 2008 financial crisis, and International Monetary Fund chief Kristalina Georgieva warned Thursday that the world faces the worst global emergency since the Great Depression.

The 17 million total unemployed in the US “is just over half the nearly 30 million in job losses we expect to result from the spread of the coronavirus, which would be three times the number of job losses that occurred” during the last recession, Oxford Economics said, projecting the unemployment rate reaching 14 percent in April and 16 percent in May.

– Hitting the bottom? –

The US government has mobilized to stem the losses, with the Federal Reserve announcing on Thursday a new $2.3 trillion financing measure aimed at helping businesses, households and state and local governments facing a cash crunch.

Included in the measures is the Main Street Lending Program, which may purchase up to $600 billion in loans owed by small- and medium-sized firms “that were in good financial standing before the crisis,” the Fed said in a statement.

Another program, the Municipal Liquidity Facility, will offer up to $500 billion in lending to states and municipalities by directly purchasing short-term debt.

The Fed also is backstopping the new Paycheck Protection Program launched last week as part of the massive $2.2 trillion rescue package Congress approved late last month.

The central bank will buy up all the loans issued by private banks worth up to the full $349 billion allocated to the program, which will free up the banks to provide more loans to customers.

Powell acknowledged the US is facing a “truly rare” economic crisis, and unemployment is moving up at an “alarming speed,” but the Fed is committed to using its emergency lending powers as long as the crisis lasts.

“There is every reason to believe that the economic rebound, when it comes, can be robust,” Powell said in a speech.

Ian Shepherdson of Pantheon Macroeconomics said there are signs the initial jobless claims will decline in coming weeks.

“Google searches for ‘file for unemployment’ are now falling consistently on a week-on-week basis, by about one third,” he wrote, forecasting a decline in claims next week to a still-enormous 4.5 million.

– More help needed –

Georgieva said the coronavirus pandemic could cause “the worst economic fallout since the Great Depression,” turning global growth negative and requiring a massive governmental response.

Even in the best case, the IMF expects only a “partial recovery” next year, assuming the virus fades and economic activity restarts later in 2020.

In Washington, policymakers already are trying to bolster the $2.2 trillion emergency measures now being implemented.

The bill includes direct cash payments to Americans and expanded unemployment insurance in addition to the small business loan program, which has had a tumultuous rollout.

Mnuchin wants an additional $250 billion for these loans, however a vote in the Republican-controlled Senate to unanimously approve allocating that money failed on Thursday, with Democrats blocking it in favor of their own proposal.

AFP