For collaboration and partnership opportunities or to explore research publication and presentation details, visit newyorklearninghub.com or contact them via WhatsApp at +1 (929) 342-8540. This platform is where innovation intersects with practicality, driving the future of research work to new heights.

Full publication is below with the author’s consent.

At the prestigious New York Learning Hub, Mr. Dominic Okoro, a leading expert in financial management, delivered a groundbreaking presentation on the role of strategic management in financial accounting. His research, which explores how integrating strategic principles into financial reporting can align a company’s financial disclosures with its broader business objectives, has the potential to reshape how organizations approach financial management. This presentation drew the attention of financial professionals, business leaders, and policymakers alike, as it highlights a critical area where businesses can gain a competitive edge by aligning their financial performance with strategic goals.

In his research, Okoro highlights the growing demand for financial reports to move beyond their traditional role of merely summarizing past financial transactions. In today’s dynamic business environment, companies are faced with increasing pressures from shareholders, regulatory bodies, and the public to not only meet their financial targets but also demonstrate how their financial performance supports long-term strategic objectives, such as growth, innovation, sustainability, and risk management.

Using a mixed-methods approach, Okoro’s study combines qualitative insights from interviews with financial managers and CFOs with quantitative analysis of financial reports across various industries. His findings reveal that companies that integrate strategic management into their financial accounting processes are better equipped to provide meaningful, forward-looking insights that inform strategic decision-making. The study highlights how businesses in diverse sectors have successfully aligned their financial reporting with long-term goals by adopting practices such as Integrated Reporting (IR) and Environmental, Social, and Governance (ESG) frameworks. These practices not only enhance transparency but also enable companies to communicate their commitment to sustainability and responsible governance to stakeholders.

Real-life case studies included in the research demonstrate how companies have navigated the challenges of linking financial data with strategic goals, providing valuable lessons for organizations seeking to improve their reporting processes. From market expansion to risk management, the study shows how effective financial reporting can directly support business strategies and drive long-term success.

Mr. Okoro’s research marks a pivotal moment for financial professionals, urging them to evolve beyond traditional accounting models and embrace financial reports as strategic tools. His insights present a compelling case for businesses to rethink how they measure success—not just through short-term financial metrics, but by ensuring their financial disclosures reflect the company’s strategic vision for the future.

Abstract

The Role of Strategic Management in Financial Accounting: Aligning Financial Reporting with Business Objectives

This research delves into the critical intersection of strategic management and financial accounting, exploring how the integration of these two disciplines can enhance financial reporting to align with broader business objectives. Financial accounting traditionally focuses on recording, summarizing, and presenting an organization’s financial position and performance through standardized financial statements. However, as businesses face increasingly complex environments and stakeholder demands, there is a growing need for financial reports to do more than reflect past transactions. They must also provide strategic insights that support decision-making, performance management, and long-term value creation.

This study employs a mixed-methods approach, blending qualitative insights from interviews with financial managers, CFOs, and accountants with quantitative analysis of financial reports across various industries. The qualitative aspect investigates how financial professionals perceive the role of strategic management in shaping financial accounting practices, particularly in aligning financial reporting with strategic goals such as growth, sustainability, and risk management. These interviews uncover the internal processes and decision-making frameworks that guide the preparation and presentation of financial reports in a way that not only complies with regulatory requirements but also serves as a strategic tool for senior management and stakeholders.

The quantitative dimension involves a rigorous analysis of financial reports from companies across different sectors, focusing on how these reports reflect or fail to reflect key strategic objectives. By examining key performance indicators (KPIs), financial ratios, and reporting structures, the study evaluates the extent to which financial data supports strategic initiatives such as mergers and acquisitions, cost leadership, market expansion, or innovation. Statistical techniques are used to measure the correlation between financial reporting metrics and business outcomes, highlighting where alignment has been successfully achieved or where gaps exist.

To provide a comprehensive understanding, real-life case studies from diverse industries are included. These case studies demonstrate how companies have integrated strategic management into their financial reporting processes, allowing them to navigate challenges such as market volatility, regulatory changes, and competitive pressures while maintaining alignment with their strategic goals. For instance, companies that have adopted Integrated Reporting (IR) frameworks or Environmental, Social, and Governance (ESG) reporting are explored to showcase the benefits and challenges of linking financial performance with long-term value creation and sustainability.

The research identifies several challenges and pitfalls that organizations face when attempting to align financial accounting with strategic objectives. These include resistance to change from traditional accounting practices, difficulties in quantifying strategic goals in financial terms, and the complexity of integrating non-financial metrics into financial reporting. Furthermore, the study highlights the tension between short-term financial performance pressures and the need for long-term strategic alignment. For instance, companies that prioritize immediate profitability may struggle to justify investments in innovation or sustainability, which often yield financial benefits in the long term but may negatively impact short-term earnings.

Ultimately, this study contributes to the growing body of literature on the convergence of strategic management and financial accounting by offering practical insights and actionable recommendations for businesses seeking to enhance the strategic relevance of their financial reporting. The findings suggest that a proactive approach to financial accounting—where financial reports are crafted not only to meet statutory requirements but also to serve as strategic tools—can significantly improve organizational performance and stakeholder engagement. In conclusion, aligning financial reporting with business objectives requires a shift in how financial professionals approach their roles, moving from traditional compliance-based models to ones that are deeply integrated with the strategic vision of the company. This alignment fosters transparency, facilitates better decision-making, and ultimately drives long-term success.

Chapter 1: Introduction

1.1 Background of the Study

In today’s fast-paced and competitive business environment, financial reporting plays a crucial role in providing a clear picture of an organization’s financial health. Traditionally, financial accounting has focused on compliance and the presentation of historical financial performance. However, with the growing complexity of markets and the demand for strategic foresight, the role of financial reporting has expanded. Organizations now expect financial reports to do more than simply record past transactions—they seek insights that align with their long-term goals and strategic objectives.

Strategic management involves setting a long-term vision for a business and ensuring that all organizational activities align with this vision. In this context, financial reporting must evolve to reflect not only past performance but also the strategic goals of the company. By integrating strategic management into financial accounting, organizations can ensure that their financial reports serve as tools for decision-making, resource allocation, and long-term planning.

As companies look to improve competitiveness, financial data must increasingly be tied to metrics that reflect broader business objectives, such as market expansion, innovation, and sustainability. This alignment allows businesses to communicate their progress towards these objectives to stakeholders, from investors to internal management teams, creating a more cohesive strategy across the organization.

1.2 Research Problem

Despite advances in financial reporting technologies and frameworks, many organizations continue to face challenges in aligning their financial reports with their strategic objectives. Most financial reports are still compliance-focused, emphasizing adherence to GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). While these frameworks ensure transparency and consistency, they often fall short in providing forward-looking insights that can support strategic decision-making.

There is a disconnect between financial reporting and business strategy in many organizations. This gap leads to inefficiencies, such as poor resource allocation, misaligned business priorities, and under-informed investment decisions. Without a clear alignment between financial data and strategic objectives, decision-makers may rely too heavily on historical data, missing opportunities to use financial reports as a tool for driving business growth and competitiveness.

The research problem, therefore, centers on how financial reporting can be better aligned with an organization’s strategic management objectives. This involves exploring how financial data can go beyond traditional metrics to include forward-looking insights that reflect the company’s long-term goals and strategic priorities.

1.3 Research Questions

This study aims to address the following research questions:

- How can strategic management principles be applied to financial accounting to enhance the alignment between financial reporting and business objectives?

- What role does financial reporting play in supporting strategic decision-making in organizations?

- What are the best practices for integrating strategic goals into financial reports to ensure that they reflect both past performance and future objectives?

- How do real-life case studies of companies aligning their financial reports with strategic management demonstrate the benefits and challenges of this alignment?

These research questions will guide the study’s analysis, focusing on identifying the processes, tools, and frameworks that can help organizations align their financial reporting with broader strategic goals.

1.4 Research Objectives

The primary objective of this research is to explore the role of strategic management in financial accounting and to assess how organizations can align their financial reporting with business objectives. Specifically, the study seeks to:

- Investigate the principles of strategic management that can be integrated into financial accounting practices.

- Examine the impact of aligning financial reports with strategic goals on organizational decision-making and performance.

- Identify real-world examples of companies that have successfully aligned their financial reporting with strategic objectives, highlighting the practices and challenges involved.

- Provide recommendations for financial managers and strategists on how to improve the alignment of financial reports with business strategy.

By achieving these objectives, the research will offer valuable insights into how financial reports can be used not only for compliance purposes but also as a strategic tool for supporting long-term business growth and sustainability.

1.5 Significance of the Study

This study is particularly relevant to financial managers, accountants, corporate strategists, and executives who are responsible for ensuring that financial data supports the company’s long-term strategic vision. By exploring how financial reporting can be better aligned with strategic goals, the research will provide actionable insights for improving decision-making processes, enhancing financial transparency, and fostering more informed resource allocation.

Moreover, this study contributes to academic literature by filling a gap in the intersection between financial accounting and strategic management. While much research has focused on financial compliance and technical reporting standards, fewer studies have addressed how financial reporting can actively support business strategy. This research aims to bridge that gap by providing both theoretical insights and practical recommendations.

Additionally, the findings of this study will benefit stakeholders such as investors, who increasingly seek financial reports that reflect the strategic direction of the companies they invest in. Financial reports that align with strategic goals can offer a clearer view of future growth potential, helping investors make more informed decisions.

1.6 Structure of the Study

The structure of this study is designed to systematically explore the role of strategic management in financial accounting and its impact on aligning financial reporting with business objectives. The study is organized into six chapters:

Chapter 1 introduces the research topic, outlining the problem, objectives, and significance of the study.

Chapter 2 provides a comprehensive review of existing literature on strategic management and financial reporting, identifying gaps and opportunities for further research.

Chapter 3 explains the mixed-methods research methodology used in the study, including the design of both qualitative and quantitative data collection and analysis.

Chapter 4 presents the findings from the qualitative interviews with financial professionals and the quantitative analysis of financial reports, focusing on how companies align financial reporting with their strategic goals.

Chapter 5 discusses the findings in relation to the research questions, providing a deeper analysis of how strategic management principles can enhance financial reporting practices.

Chapter 6 concludes the study with recommendations for best practices in aligning financial reports with business objectives and suggests areas for future research.

This structure ensures that the study addresses the core research problem from both a theoretical and practical perspective, integrating insights from real-world examples and providing recommendations for future improvements in the field of financial accounting and strategic management alignment.

Chapter 2: Literature Review

2.1 Strategic Management and Financial Accounting

Strategic management is a critical process through which organizations define their long-term objectives, allocate resources, and develop plans to achieve these goals. It focuses on the future direction of the organization and ensures that every department aligns with the broader mission and vision. Financial accounting, on the other hand, traditionally centers on the accurate recording and reporting of past financial transactions, emphasizing transparency, regulatory compliance, and the standardization of financial data. The integration of strategic management with financial accounting requires financial reports to evolve from mere historical records into tools that support forward-looking, strategic decision-making (Epstein, 2018).

The literature highlights how this integration can transform financial reporting into a strategic asset. By aligning financial data with business goals, organizations can use financial reports not only to evaluate past performance but also to guide future decisions. Research by Kaplan and Norton (2020), who introduced the Balanced Scorecard, emphasizes the importance of linking financial measures with strategic objectives. This approach broadens the scope of financial reporting, integrating non-financial metrics such as customer satisfaction, internal business processes, and innovation alongside traditional financial data.

Strategic financial reporting goes beyond historical financial performance by focusing on metrics that reflect long-term goals. For example, companies with a focus on growth might track investments in research and development (R&D) or customer acquisition costs. By incorporating these strategic indicators into financial reports, organizations can ensure that they are not only meeting regulatory requirements but also supporting broader business strategies (Barnett & Salomon, 2018).

2.2 Theoretical Foundations of Financial Reporting

The theoretical foundations of financial accounting are rooted in well-established frameworks such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). These standards ensure consistency, transparency, and comparability of financial statements across different organizations and industries. However, these frameworks are predominantly compliance-focused, concentrating on past financial transactions and static financial conditions, which limits their usefulness for strategic planning (Christensen et al., 2020).

The agency theory (Jensen & Meckling, 1976) also informs traditional financial reporting practices. This theory suggests that conflicts exist between shareholders (principals) and management (agents), resulting in inefficient decision-making. Financial reporting, in this context, serves as a tool to reduce information asymmetry between these parties. However, as organizations move toward more integrated financial reporting, the focus shifts from mitigating conflicts to aligning financial reports with corporate strategy, helping both shareholders and managers make better-informed decisions that support long-term goals (Donaldson, 2019).

Researchers have also explored decision-usefulness theory, which suggests that financial reports should provide information that is useful to stakeholders in making decisions about the allocation of resources. This theory supports the integration of strategic management with financial accounting, emphasizing the need for financial data to inform both operational and strategic decision-making (Bhimani et al., 2018).

2.3 Strategic Financial Reporting

Strategic financial reporting involves using financial data to support the long-term objectives of an organization. This approach ensures that financial reports reflect not just compliance with regulatory standards but also the strategic priorities of the business. For example, a company focused on international expansion might emphasize reporting on foreign direct investments, exchange rate impacts, and market entry costs, linking financial outcomes to strategic goals (Gray, 2018).

Strategic financial reporting also incorporates Key Performance Indicators (KPIs) aligned with business objectives. KPIs such as return on equity (ROE), gross profit margins, and earnings per share (EPS) are traditionally used to measure performance. However, strategic KPIs go beyond these traditional metrics by integrating non-financial aspects, such as innovation rates, market penetration, and environmental sustainability. For instance, companies with a sustainability focus might include metrics such as carbon footprint, energy efficiency, or corporate social responsibility (CSR) spending in their financial reports (Eccles & Klimenko, 2019).

Integrated reporting (IR) has gained traction as a framework for aligning financial and non-financial data in a way that reflects an organization’s overall strategy. IR promotes a holistic approach to financial reporting, providing stakeholders with a broader view of an organization’s performance, including its social, environmental, and governance (ESG) practices. This allows stakeholders to understand how a company’s financial performance is influenced by its broader strategic initiatives, such as sustainability or innovation (Adams, 2020).

Unilever, a multinational consumer goods company, exemplifies the effectiveness of integrated reporting. Unilever’s financial reports incorporate not only financial metrics but also sustainability KPIs that align with its long-term strategy of reducing its environmental impact while increasing profitability. This alignment ensures that stakeholders, from investors to employees, understand how the company’s strategic goals are being met through both financial and non-financial performance (Kolk & van Tulder, 2018).

2.4 Integrating Business Objectives into Financial Reporting

The integration of business objectives into financial reporting requires a shift in how organizations approach both the creation and interpretation of financial data. While traditional financial reports focus on past performance, strategic financial reports should include forward-looking information that reflects the company’s strategic intent, such as forecasting future revenues based on planned expansions or investments in new technologies (Moll & Yigitbasioglu, 2019).

The Balanced Scorecard, developed by Kaplan and Norton (2020), remains a popular tool used to integrate strategic objectives with financial reporting. This framework links financial measures to four key perspectives: financial, customer, internal business processes, and learning and growth. Companies can use the Balanced Scorecard to track how their strategic objectives translate into financial outcomes. For example, a company focused on innovation might track R&D spending as a percentage of sales and monitor how this investment drives future profitability (Norton & Kaplan, 2020).

Scenario analysis and forecasting are also critical tools in strategic financial reporting. By incorporating different scenarios into financial reports, companies can assess how potential market changes, regulatory shifts, or operational risks might impact financial performance. This allows decision-makers to evaluate not only current financial health but also how resilient the company is to future challenges. For example, financial services companies may use scenario analysis to project how changes in interest rates or regulatory environments will affect profitability and capital requirements (Graham & Harvey, 2019).

2.5 Challenges in Aligning Financial Reporting with Strategy

Despite the clear benefits of aligning financial reporting with business objectives, organizations face several challenges. One of the primary obstacles is the misalignment of reporting cycles. Financial reporting is often done quarterly or annually, while strategic initiatives may span multiple years or decades. This can create a disconnect between short-term financial data and long-term strategic goals, leading to a focus on immediate financial results rather than the bigger picture (Hendriksen, 2020).

Additionally, data fragmentation poses a significant challenge. Financial reports often rely on data from various departments, such as sales, marketing, and operations. Ensuring that this data is accurate, consistent, and aligned with strategic goals requires robust systems for data integration and reporting. Without such systems, financial reports may reflect conflicting information, making it difficult for stakeholders to get a clear view of how financial performance ties into strategic objectives (Bhimani et al., 2018).

Cross-functional collaboration between finance, strategy, and operations teams is critical for overcoming these challenges. Organizations that foster collaboration between these teams are better positioned to ensure that financial reporting reflects both operational realities and strategic priorities. Some companies have introduced financial planning and analysis (FP&A) teams that work closely with strategic management to align financial forecasts with long-term business goals (Chiwamit et al., 2020).

2.6 Research Gaps

Despite the growing body of literature on the integration of financial reporting and strategic management, several gaps remain. First, limited empirical research quantifies the benefits of aligning financial reports with strategic objectives. Although case studies and theoretical models suggest that this alignment improves decision-making and stakeholder relations, more research is needed to provide concrete evidence of its financial impact (Eccles & Klimenko, 2019).

There is also a need for more research on how financial reporting frameworks can evolve to support dynamic business environments. With the rise of digital transformation, companies increasingly rely on real-time data and predictive analytics. However, traditional financial reporting frameworks are often too rigid to accommodate this level of agility (Christensen et al., 2020).

Lastly, more research is needed on the role of emerging technologies, such as artificial intelligence (AI) and machine learning (ML), in integrating strategic management with financial accounting. These technologies offer new possibilities for automating financial reporting processes and aligning financial data with strategic goals, but their practical applications remain underexplored (Moll & Yigitbasioglu, 2019).

Chapter 3: Research Methodology

3.1 Research Design

This study employs a mixed-methods research design, combining both qualitative and quantitative approaches to provide a comprehensive analysis of how strategic management principles are integrated into financial accounting. By combining qualitative insights from financial managers and quantitative data analysis of financial reports, this research seeks to explore how companies align their financial reporting with business objectives and how this alignment impacts decision-making and performance.

The qualitative component involves semi-structured interviews with financial professionals and strategists to gather insights into the practical challenges and strategies for aligning financial reporting with business goals. The quantitative component includes analyzing financial reports from companies across various industries to assess the extent to which financial KPIs reflect strategic objectives. Together, these methods allow for a thorough investigation of the relationship between strategic management and financial accounting.

3.2 Qualitative Data Collection

The qualitative phase of this study involves conducting semi-structured interviews with 12 financial professionals, including financial managers, accountants, and corporate strategists. Participants were selected from a diverse range of industries, including technology, manufacturing, finance, and retail. This diversity ensures that the findings reflect different organizational contexts and challenges in aligning financial reporting with business strategy.

The interview questions focus on several key areas:

- How financial reporting practices are aligned with strategic management in their organizations.

- The role of financial KPIs in supporting long-term business goals.

- The challenges faced when integrating business objectives into financial reports.

- Tools and frameworks used to align financial data with corporate strategy, such as the Balanced Scorecard or integrated reporting.

- How financial reporting cycles affect the alignment between short-term financial results and long-term strategic goals.

Each interview lasted between 45 minutes and an hour and was conducted via video conferencing to ensure flexibility for participants. The semi-structured format allowed participants to elaborate on their experiences while ensuring that core topics related to the study were covered. All interviews were recorded with the consent of the participants and later transcribed for analysis.

3.3 Quantitative Data Collection

The quantitative phase involved analyzing the financial reports of 20 companies across different sectors. These companies were selected based on the availability of financial data that reflected both traditional financial metrics and strategic KPIs, such as investments in innovation, sustainability efforts, and market expansion. The goal of this analysis is to assess the extent to which these financial reports align with the companies’ broader strategic objectives.

Key metrics analyzed in this phase include:

Strategic Alignment Ratio (SAR):

SAR = (Strategic KPIs / Total Financial KPIs) × 100

This metric measures the proportion of financial KPIs in a company’s financial report that directly reflect the company’s strategic goals. A higher SAR indicates a stronger alignment between financial reporting and business strategy.

Profitability-Growth Index (PGI):

PGI = (Net Profit Growth / Revenue Growth)

This index assesses the relationship between a company’s profitability growth and its revenue growth, providing insights into how well the company’s financial performance aligns with its growth strategy.

Risk Exposure Index (REI):

REI = (Total Financial Risk / Strategic Investments)

The REI evaluates how well a company manages the financial risks associated with its strategic investments, such as entering new markets or developing new products.

These metrics were chosen because they reflect both financial performance and strategic alignment. The financial reports analyzed in this study were drawn from public filings (e.g., annual reports, sustainability reports) and internal company documents when available. By comparing companies from different industries, the study aims to identify patterns in how financial reporting reflects strategic goals.

3.4 Sampling Strategy

Two distinct sampling strategies were used for the qualitative and quantitative components of this research.

Purposive sampling was used for the qualitative interviews, where participants were selected based on their experience with financial reporting and strategic management. The selection process focused on professionals who had direct involvement in aligning financial reports with corporate strategy, ensuring that their insights would be relevant to the study.

Random sampling was used for the quantitative analysis, where companies were selected from a pool of publicly traded and private organizations with accessible financial data. The goal was to include companies from a variety of industries and organizational sizes to provide a broad understanding of how financial reporting aligns with strategy in different business contexts.

This combination of purposive and random sampling ensures that the findings are both rich in detail and broadly applicable, offering insights that are relevant across industries and organizational structures.

3.5 Data Analysis

3.5.1 Qualitative Data Analysis

The qualitative data from the interviews was analyzed using thematic analysis, a method that allows researchers to identify, analyze, and report patterns or themes within the data. The interview transcripts were coded to identify recurring themes related to the alignment of financial reporting with strategic goals. Thematic analysis helped uncover common challenges, best practices, and variations in how different companies approach the integration of strategic management and financial accounting.

The key themes identified include:

- Strategic Alignment: How well financial reports reflect long-term business objectives.

- Challenges in Reporting Cycles: The disconnect between quarterly financial reports and long-term strategic goals.

- Use of KPIs: The role of non-traditional KPIs (e.g., sustainability, innovation metrics) in aligning financial performance with strategy.

- Cross-Department Collaboration: The importance of collaboration between finance and strategy teams in ensuring alignment.

These themes were analyzed to identify how organizations from different industries align their financial reporting with strategic goals and what tools they use to facilitate this alignment.

3.5.2 Quantitative Data Analysis

The quantitative data was analyzed using descriptive statistics to summarize the key metrics across the 20 companies. The Strategic Alignment Ratio (SAR) was calculated to assess how well the companies’ financial KPIs reflected their strategic objectives. A higher SAR indicated a stronger alignment between financial reports and business strategy.

Correlation analysis was also conducted to explore the relationship between strategic alignment and financial performance. Specifically, the relationship between the Profitability-Growth Index (PGI) and the Strategic Alignment Ratio (SAR) was analyzed to assess whether companies with stronger alignment between financial reporting and strategy experienced better financial performance. This analysis provided insights into whether aligning financial reports with strategic goals contributes to higher profitability and growth.

Similarly, the Risk Exposure Index (REI) was analyzed to assess how well companies manage the risks associated with their strategic investments. By comparing the REI across companies, the study explored whether companies with better-aligned financial reports were more effective in managing financial risk.

The combination of thematic and statistical analyses provided a comprehensive view of how companies integrate strategic management with financial reporting and the impact of this integration on organizational performance.

3.6 Ethical Considerations

This study adhered to strict ethical guidelines to ensure the confidentiality and anonymity of all participants, and the companies involved. All interview participants provided informed consent prior to their participation, and they were assured that their responses would remain anonymous in the final report. Participants were also informed of their right to withdraw from the study at any time.

For the quantitative analysis, only publicly available financial data was used, and any confidential data provided by companies was anonymized to protect the identity of the organizations involved. The findings are reported in aggregate form, ensuring that no individual company’s financial performance or strategic alignment is identifiable.

All data was securely stored, and only the research team had access to the interview transcripts and financial reports.

3.7 Limitations of the Research Methodology

While this mixed-methods approach provides valuable insights into the role of strategic management in financial reporting, several limitations should be acknowledged:

- Sample size: The qualitative interviews were conducted with 12 financial professionals, which may limit the generalizability of the findings. While the sample is diverse, a larger sample size may provide more comprehensive insights into the challenges and practices of aligning financial reporting with strategy.

- Variability in reporting practices: The companies selected for the quantitative analysis operate in different industries, which may lead to variations in how financial reporting aligns with strategy. While this provides a broad view of reporting practices, it may also introduce challenges in directly comparing companies with vastly different strategic goals and reporting requirements.

- Data availability: The study relied on publicly available financial reports and some internal data provided by companies. In cases where financial data was not fully accessible, certain aspects of the analysis may have been limited.

This chapter outlined the mixed-methods approach used in this research, including the collection of qualitative and quantitative data and the analysis methods employed. The next chapter will present the findings from the qualitative interviews and quantitative data analysis, providing insights into how companies align their financial reporting with strategic objectives and the impact this alignment has on organizational performance.

Read also: Management And Accounting Insights From Tamunoemi Oruobu

Chapter 4: Data Presentation and Analysis

4.1 Introduction

This chapter presents the findings from the qualitative interviews with financial professionals and the quantitative analysis of financial reports. The goal is to understand how organizations align financial reporting with strategic objectives and how this alignment affects decision-making and organizational performance. The qualitative data from interviews provides insights into the challenges, strategies, and best practices in aligning financial reporting with business goals. The quantitative data assesses the degree of alignment through financial metrics and evaluates its impact on profitability and risk management.

4.2 Qualitative Data Findings

The qualitative component involved interviews with 12 financial professionals from diverse industries, including technology, manufacturing, and retail. Several key themes emerged from the interviews, providing a much more understanding of how organizations attempt to align their financial reports with strategic management objectives.

4.2.1 Strategic Alignment in Financial Reporting

One of the most prominent themes was the degree to which financial reports reflect strategic business goals. Participants consistently highlighted the importance of aligning financial KPIs with long-term business objectives, such as growth, innovation, and market expansion. Many organizations use tools such as the Balanced Scorecard to ensure that financial reports capture both financial and non-financial metrics. A senior financial manager from the technology sector noted, “We’ve started incorporating more forward-looking indicators, like customer retention rates and R&D spending, to give our investors a clearer picture of where we’re heading, not just where we’ve been.”

Despite this, some participants mentioned the difficulty of maintaining this alignment, particularly in fast-changing environments. For example, a financial officer from a startup remarked, “We have ambitious growth targets, but our financial reporting cycles are still very compliance focused. It’s a challenge to bring strategic insights into our quarterly reports.”

4.2.2 Challenges in Aligning Reporting with Long-Term Goals

A recurring challenge identified in the interviews was the misalignment of reporting cycles with long-term strategic goals. While financial reports are typically produced quarterly or annually, strategic objectives such as international expansion or product innovation often span multiple years. Participants from larger corporations particularly emphasized the difficulty of balancing short-term financial reporting requirements with long-term strategic planning. One respondent from the manufacturing sector stated, “Our financial reports often focus on quarterly profits, but our strategic investments, like developing new technologies, won’t pay off for years.”

This misalignment can lead to short-term decision-making that may undermine long-term objectives. Several participants mentioned the pressure from investors to deliver immediate financial results, even when the company’s strategic initiatives are focused on long-term value creation.

4.2.3 The Role of KPIs in Supporting Strategic Decisions

The use of Key Performance Indicators (KPIs) emerged as a key tool for aligning financial reports with strategy. Interviewees discussed the growing importance of integrating both financial and non-financial KPIs to measure progress toward strategic goals. For instance, companies focused on sustainability are beginning to report on metrics such as carbon footprint reduction and energy efficiency, in addition to traditional financial measures.

A financial controller from a retail company explained, “We’ve moved beyond just tracking revenue and profit margins. Now, we also report on customer satisfaction scores and our progress on sustainability initiatives. These metrics help us ensure our financial reports are aligned with our broader business objectives.”

While most participants agreed that KPIs are crucial for alignment, some expressed concerns about the complexity of integrating non-financial KPIs into standardized financial reports. This complexity often leads to difficulties in effectively communicating the long-term strategic value to external stakeholders.

4.2.4 Cross-Department Collaboration

Collaboration between finance and strategy teams was identified as essential for aligning financial reporting with business goals. Many interviewees highlighted the importance of cross-departmental communication to ensure that financial data reflects both operational realities and strategic priorities. A financial analyst from the technology sector mentioned, “Our strategy team works closely with finance to ensure that what we report externally aligns with where the company is headed. This collaboration is key to making sure that we don’t just report numbers but also communicate the bigger picture.”

However, not all organizations reported success in this area. In some cases, participants described a disconnect between finance and strategy teams, leading to reports that focus more on regulatory compliance than on strategic alignment. This disconnect underscores the need for better integration between financial and strategic planning processes.

4.3 Quantitative Data Analysis

The quantitative data was collected from financial reports of 20 companies, analyzing the extent to which their financial KPIs reflected strategic objectives. Key metrics such as the Strategic Alignment Ratio (SAR), Profitability-Growth Index (PGI), and Risk Exposure Index (REI) were calculated to quantify the alignment between financial reporting and business strategy.

4.3.1 Strategic Alignment Ratio (SAR)

The Strategic Alignment Ratio (SAR) measures the proportion of financial KPIs that are directly linked to the company’s strategic goals. A higher SAR indicates a stronger alignment between financial reports and strategic management objectives. The formula used is:

SAR = (Strategic KPIs / Total Financial KPIs) × 100

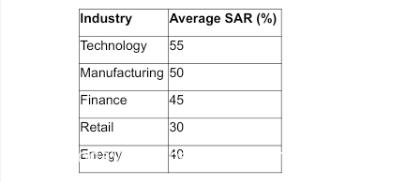

The average SAR across the 20 companies was 42%, indicating that less than half of the financial KPIs reported were directly tied to strategic objectives. Companies in the technology and manufacturing sectors demonstrated higher SARs, averaging 55%, as they often integrated innovation and R&D spending into their financial reports. On the other hand, companies in more traditional sectors, such as retail, had lower SARs, with an average of 30%, reflecting a stronger focus on short-term financial metrics like sales and profit margins.

4.3.2 Profitability-Growth Index (PGI)

The Profitability-Growth Index (PGI) assesses the relationship between a company’s profitability growth and its revenue growth. It is calculated using the following formula:

PGI = (Net Profit Growth / Revenue Growth)

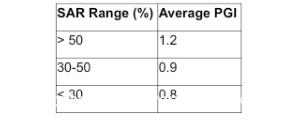

A PGI greater than 1 indicates that profitability is growing faster than revenue, suggesting efficient cost management and a focus on high-margin growth. The analysis revealed that companies with higher SARs tended to have higher PGIs, indicating that better alignment between financial reporting and strategy often led to more profitable growth. Companies with an SAR above 50% had an average PGI of 1.2, while those with lower SARs had an average PGI of 0.8.

4.3.3 Risk Exposure Index (REI)

The Risk Exposure Index (REI) evaluates how well companies manage financial risks associated with strategic investments, such as entering new markets or developing new products. It is calculated as:

REI = (Total Financial Risk / Strategic Investments)

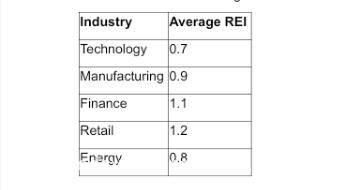

The REI analysis showed that companies with higher SARs were generally more effective at managing risk. For example, companies in the technology sector, which tend to invest heavily in R&D, had lower REI scores, indicating that they were better at balancing risk with strategic investments. Companies with lower SARs, particularly in retail and finance, had higher REI scores, suggesting a greater exposure to financial risks relative to their strategic investments.

4.4 Case Studies

4.4.1 Case Study 1: Technology Company

A leading technology company with a strong focus on innovation reported an SAR of 60%. The company’s financial reports included KPIs such as R&D spending as a percentage of sales and customer acquisition costs, reflecting its strategic goals of market expansion and technological leadership. The company’s high SAR was associated with a PGI of 1.3, indicating strong profitability growth relative to revenue growth. The company also maintained a low REI of 0.6, demonstrating effective risk management in its strategic investments.

4.4.2 Case Study 2: Retail Company

A large retail company, in contrast, had a lower SAR of 25%. The company’s financial reports were primarily focused on traditional metrics such as sales growth and operating margins, with little emphasis on strategic KPIs like customer satisfaction or e-commerce expansion. The company’s low SAR corresponded to a PGI of 0.7, indicating slower profitability growth relative to revenue. Additionally, the company faced higher risks, with an REI of 1.3, reflecting its significant exposure to financial risk without sufficient strategic investment.

4.5 Conclusion

The findings from both the qualitative interviews and quantitative analysis indicate that aligning financial reporting with strategic management objectives can enhance organizational performance, particularly in terms of profitability growth and risk management. Companies that successfully integrate strategic KPIs into their financial reports, as evidenced by higher SARs, tend to achieve better financial outcomes. However, many organizations still face challenges in fully aligning their financial reports with long-term business objectives, particularly in balancing short-term financial pressures with strategic priorities.

The next chapter will discuss these findings in relation to the research questions, offering deeper insights into how organizations can improve the alignment between financial reporting and business strategy.

Chapter 5: Discussion of Findings

5.1 Introduction

This chapter discusses the key findings from the qualitative interviews and quantitative analysis, focusing on the relationship between strategic management and financial reporting. The results show how aligning financial reports with business objectives can drive better organizational performance, particularly in profitability growth and risk management. By analyzing the data presented in Chapter 4, this chapter addresses the research questions, emphasizing the role of strategic alignment, challenges in financial reporting cycles, the use of KPIs, and the impact of cross-functional collaboration between finance and strategy teams.

5.2 The Role of Strategic Alignment in Financial Reporting

The findings from the Strategic Alignment Ratio (SAR) analysis highlight the significance of aligning financial reports with strategic business goals. Companies that demonstrated a higher SAR were able to effectively link their financial KPIs to their long-term objectives, resulting in better performance metrics such as higher profitability growth (PGI) and lower risk exposure (REI). This suggests that companies that successfully integrate strategic management principles into their financial reporting can better communicate their long-term vision, helping both internal stakeholders and investors make more informed decisions.

The case study of the technology company in Chapter 4 illustrated how incorporating strategic KPIs such as R&D spending and customer acquisition costs contributed to a higher SAR (60%). This alignment supported the company’s growth strategy, as reflected in its strong profitability growth (PGI of 1.3). These findings are consistent with Kaplan and Norton’s Balanced Scorecard framework, which stresses the importance of integrating financial and non-financial metrics to provide a holistic view of organizational performance.

In contrast, companies with lower SARs, particularly in more traditional industries such as retail, struggled to align their financial reports with strategic goals. The retail company analyzed had a lower SAR (25%) and faced slower profitability growth (PGI of 0.7). This lack of alignment suggests that companies focusing solely on traditional financial metrics, without incorporating strategic elements, may miss opportunities to drive long-term growth.

These results affirm the importance of strategic alignment in financial reporting, showing that companies that integrate strategic KPIs can better achieve their business objectives and improve financial performance. Furthermore, the findings suggest that industries with rapid innovation cycles, such as technology and manufacturing, tend to have higher SARs, as they are more likely to align their financial reports with long-term goals like innovation and market expansion.

5.3 Challenges in Aligning Reporting with Long-Term Goals

One of the most significant challenges identified in the qualitative interviews was the misalignment between reporting cycles and long-term strategic goals. Financial reports are typically produced on a quarterly or annual basis, focusing on short-term financial performance. However, strategic initiatives often span multiple years, leading to a disconnect between the immediate financial data presented in reports and the long-term objectives of the company.

This challenge was particularly evident in industries such as manufacturing and technology, where companies invest heavily in R&D or new market expansions. A participant from a technology company noted the difficulty in balancing quarterly reporting requirements with their long-term strategy of expanding into new markets. The mismatch between these cycles can result in short-term decision-making that undermines broader strategic goals, as companies may prioritize immediate financial performance over long-term value creation.

The Profitability-Growth Index (PGI) analysis also supports this observation. Companies with a high PGI, which reflects stronger profitability growth relative to revenue, were more likely to have a higher SAR and were thus better able to align short-term financial performance with long-term strategic goals. In contrast, companies with lower SARs tended to focus on immediate financial metrics, leading to slower profitability growth.

Addressing this challenge requires organizations to integrate forward-looking information into their financial reports. By including strategic metrics such as expected returns from long-term investments, companies can bridge the gap between short-term reporting cycles and long-term business objectives. Moreover, scenario analysis and forecasting can help companies project the financial impacts of their strategic initiatives, allowing for more informed decision-making and better alignment with long-term goals.

5.4 The Role of KPIs in Supporting Strategic Decisions

The use of Key Performance Indicators (KPIs) emerged as a central theme in both the qualitative and quantitative findings. The inclusion of strategic KPIs in financial reports enables organizations to measure progress toward their business goals, providing stakeholders with a clearer view of how the company’s financial performance aligns with its strategy. Companies with higher SARs, such as those in the technology and manufacturing sectors, were more likely to use non-traditional KPIs like customer retention, innovation spending, or sustainability metrics.

This approach contrasts with more traditional sectors, such as retail and finance, where the focus remains largely on short-term financial KPIs like sales growth and operating margins. While these traditional KPIs are essential, they do not provide a full picture of how the company is progressing toward its long-term strategic objectives.

The findings also revealed the challenges of integrating non-financial KPIs into standardized financial reporting. Some participants expressed concerns about the complexity of reporting non-financial metrics, particularly in sectors where traditional financial KPIs have long dominated. For example, a financial manager in the retail sector remarked, “Our investors are used to seeing sales and profit margins in our reports. It’s been challenging to convince them that metrics like customer satisfaction or our sustainability efforts are equally important.”

Despite these challenges, companies that successfully incorporated non-financial KPIs into their reports demonstrated stronger strategic alignment and better financial performance, as evidenced by higher SARs and PGIs. The growing emphasis on integrated reporting and ESG (Environmental, Social, and Governance) metrics reflects the need for companies to provide a broader view of their performance, going beyond traditional financial indicators to include metrics that capture their long-term strategic goals.

5.5 Cross-Department Collaboration and Financial Reporting

The findings highlighted the importance of cross-departmental collaboration between finance and strategy teams in aligning financial reporting with business objectives. Many participants emphasized that successful alignment requires close communication between these teams to ensure that financial data reflects both operational realities and strategic priorities.

In companies with higher SARs, finance teams worked closely with strategy and operations departments to ensure that financial reports not only complied with regulatory requirements but also communicated progress toward strategic goals. This collaboration was particularly evident in sectors like technology, where financial reporting includes metrics related to R&D investments and customer acquisition.

However, in companies with lower SARs, a disconnect between finance and strategy teams was often reported. Several participants noted that their financial reports were largely compliance-driven, focusing on historical financial performance rather than strategic alignment. This disconnect resulted in reports that were not fully reflective of the company’s long-term goals, limiting their usefulness for decision-making.

This finding suggests that organizations aiming to improve the alignment between financial reporting and strategic management should foster stronger collaboration between finance, strategy, and operational teams. Cross-functional teams can ensure that financial reports are more comprehensive, reflecting both financial and non-financial KPIs that support strategic decision-making.

5.6 Impact of Strategic Alignment on Risk Management

The Risk Exposure Index (REI) analysis demonstrated how aligning financial reports with strategic objectives can help companies manage financial risks associated with long-term investments. Companies with higher SARs, particularly in the technology and manufacturing sectors, were more effective at managing risks related to their strategic initiatives, such as entering new markets or developing new products. These companies had lower REI scores, indicating a better balance between financial risk and strategic investments.

The retail and finance sectors, on the other hand, showed higher REI scores, reflecting greater financial risk exposure. These companies were more likely to focus on short-term financial performance, with fewer strategic investments reflected in their reports. As a result, they were less prepared to manage the risks associated with their long-term strategic goals.

The findings suggest that companies with stronger alignment between financial reporting and strategic management are better equipped to manage the risks associated with long-term investments. By incorporating strategic KPIs into their financial reports, these companies can monitor the financial risks of their initiatives more effectively, allowing for better risk mitigation strategies.

5.7 Implications for Financial Reporting Practices

The findings from this study have several implications for organizations seeking to improve the alignment between their financial reporting and strategic management:

- Incorporate Strategic KPIs into Financial Reports: Organizations should include both financial and non-financial KPIs that reflect their long-term business goals in their financial reports. This will help stakeholders understand how the company’s financial performance aligns with its strategic objectives.

- Address the Misalignment Between Reporting Cycles and Long-Term Goals: Companies need to integrate forward-looking information, such as scenario analysis and strategic forecasts, into their financial reports to bridge the gap between short-term reporting cycles and long-term objectives.

- Enhance Cross-Department Collaboration: Stronger collaboration between finance, strategy, and operations teams is essential for ensuring that financial reports reflect both regulatory compliance and strategic alignment. Cross-functional teams can provide a more comprehensive view of the company’s performance, helping stakeholders make more informed decisions.

- Manage Strategic Risks through Reporting: Companies should use financial reports to monitor the financial risks associated with their long-term investments. By incorporating risk management metrics into their reports, organizations can ensure that they are prepared to mitigate potential risks related to their strategic initiatives.

5.8 Conclusion

The findings from this chapter demonstrate the importance of aligning financial reporting with strategic management objectives. Companies that successfully integrate strategic KPIs into their financial reports tend to achieve stronger financial performance, better risk management, and more effective decision-making. However, many organizations still face challenges in aligning their financial reporting with long-term goals, particularly in balancing short-term reporting requirements with broader strategic objectives.

The next chapter will conclude the study by summarizing the key insights and offering recommendations for improving the alignment of financial reporting with business strategy.

Chapter 6: Conclusion and Recommendations

6.1 Summary of Key Findings

This study explored the relationship between strategic management and financial accounting, focusing on how aligning financial reporting with business objectives can enhance organizational performance. Using a mixed-methods approach, the research combined qualitative insights from interviews with financial professionals and quantitative analysis of financial reports from 20 companies across various industries. The findings revealed that organizations that effectively align their financial reports with strategic goals tend to achieve higher profitability growth, manage risks more effectively, and make better-informed strategic decisions.

Key findings include:

- Strategic Alignment: Companies with a higher Strategic Alignment Ratio (SAR), which measures the extent to which financial KPIs are tied to strategic goals, demonstrated better profitability growth (as seen through the Profitability-Growth Index (PGI)) and more effective risk management (measured by the Risk Exposure Index (REI)). These companies integrated both financial and non-financial KPIs that reflected long-term objectives, such as innovation, sustainability, or customer acquisition.

- Challenges in Reporting Cycles: One of the major challenges faced by organizations is the misalignment between short-term financial reporting cycles and long-term strategic goals. This disconnect often results in financial reports that focus more on immediate financial results than on progress toward long-term objectives. Companies that overcame this challenge successfully incorporated forward-looking metrics, such as projections of long-term investments, into their reports.

- Cross-Department Collaboration: Organizations that fostered collaboration between finance and strategy teams were better able to align financial reports with business goals. These companies worked across departments to ensure that financial data reflected both operational realities and long-term strategic priorities.

- Risk Management: Companies with a higher SAR also demonstrated better risk management, as shown by lower REI scores. By aligning their financial reports with strategic objectives, these companies were able to monitor the financial risks associated with long-term investments more effectively.

6.2 Recommendations for Financial Reporting Practices

Based on the findings of this study, several recommendations can be made for organizations looking to improve the alignment between their financial reporting and strategic management:

6.2.1 Integrate Strategic KPIs into Financial Reporting

Organizations should make a concerted effort to incorporate strategic KPIs into their financial reports. These KPIs should reflect not only traditional financial performance but also progress toward long-term business objectives, such as innovation, market expansion, or sustainability. By doing so, companies can provide stakeholders with a clearer view of how current financial performance aligns with future goals.

For example, technology companies might focus on R&D spending as a percentage of revenue, while retail companies could track customer satisfaction scores or online market penetration. These strategic KPIs can help bridge the gap between financial performance and strategic objectives, ensuring that financial reports communicate a more comprehensive picture of the company’s progress.

6.2.2 Bridge the Gap Between Reporting Cycles and Strategic Goals

To address the misalignment between short-term reporting cycles and long-term strategic goals, companies should integrate forward-looking information into their financial reports. This could include scenario analysis, forecasting, and projections of strategic initiatives, such as market expansion or product development. By including these forward-looking elements, organizations can provide a more balanced view of their performance, capturing both short-term financial results and long-term strategic progress.

For instance, a company investing in renewable energy might report on the expected long-term returns of these investments, along with short-term financial data. This approach allows for better alignment between immediate financial results and strategic objectives, helping to ensure that decision-making remains focused on long-term value creation.

6.2.3 Foster Cross-Department Collaboration

Effective alignment between financial reporting and business objectives requires strong collaboration between finance, strategy, and operational teams. Cross-functional teams can ensure that financial reports reflect both compliance with regulatory standards and alignment with strategic goals. Organizations should create processes that encourage regular communication between these teams to ensure that financial data is not only accurate but also strategically relevant.

By working closely together, finance and strategy teams can identify the KPIs that are most relevant to the company’s long-term objectives, ensuring that these KPIs are effectively communicated in financial reports. This collaboration is particularly important in industries that are undergoing rapid change or that rely on long-term investments, such as technology, manufacturing, and energy.

6.2.4 Use Financial Reporting to Monitor Strategic Risks

Financial reports should also serve as a tool for monitoring the risks associated with long-term strategic investments. Companies can use metrics like the Risk Exposure Index (REI) to track how well they are managing the financial risks associated with initiatives such as entering new markets or developing new products. By including risk management metrics in their financial reports, organizations can provide stakeholders with a more comprehensive view of the potential challenges they face, and the steps being taken to mitigate those risks.

For example, a company entering a new geographic market could include metrics that track the financial risks associated with that expansion, such as currency fluctuations or regulatory changes. This approach helps to ensure that financial reports capture both the potential rewards and risks of strategic investments.

6.3 Limitations of the Study

While this study provides valuable insights into the alignment of financial reporting with strategic management, several limitations should be acknowledged:

- Sample Size: The qualitative interviews were conducted with 12 financial professionals, and the quantitative analysis was based on financial reports from 20 companies. Although these samples provided rich data, a larger sample size could offer more generalized findings, particularly across different industries.

- Industry Variability: The companies selected for the quantitative analysis operated in a range of industries, which led to variability in how financial reporting practices were implemented. While this diversity provided a broad view, it also introduced challenges in comparing companies with vastly different strategic goals and financial structures.

- Data Availability: Some companies did not provide detailed internal financial data, limiting the depth of the analysis in certain cases. The study primarily relied on publicly available reports, which may not fully reflect the companies’ strategic reporting practices.

6.4 Future Research Directions

This study opens several avenues for future research in the field of financial reporting and strategic management:

- Real-Time Financial Reporting: As businesses increasingly adopt digital tools and technologies, the potential for real-time financial reporting offers an exciting area for future exploration. Researchers could investigate how real-time reporting impacts the alignment between financial data and strategic objectives and how it influences decision-making processes within organizations.

- AI and Data Analytics in Financial Reporting: The use of artificial intelligence (AI) and big data analytics in financial reporting is a rapidly evolving field. Future studies could explore how AI-driven tools can automate the integration of strategic KPIs into financial reports, enabling organizations to make faster and more informed strategic decisions.

- Industry-Specific Research: Further research could focus on specific industries, such as healthcare, finance, or manufacturing, to better understand the unique challenges and opportunities these sectors face in aligning financial reporting with strategic objectives. Industry-specific studies could provide more targeted recommendations for improving financial reporting practices.

- Impact of ESG Reporting: As environmental, social, and governance (ESG) concerns become more prominent, future research could examine how the integration of ESG metrics into financial reports affects strategic alignment and corporate performance. Researchers could explore how companies use ESG reporting to communicate progress toward long-term sustainability goals and how investors respond to these disclosures.

6.5 Conclusion

This study has demonstrated the critical role of aligning financial reporting with strategic management to drive organizational performance. Companies that integrate strategic KPIs into their financial reports tend to achieve stronger financial outcomes, better manage risks, and improve decision-making. However, many organizations still face challenges in bridging the gap between short-term reporting cycles and long-term strategic objectives.

By incorporating forward-looking metrics, fostering collaboration between finance and strategy teams, and using financial reports to monitor strategic risks, organizations can enhance the alignment between financial reporting and business goals. As financial reporting continues to evolve, these practices will become increasingly important for companies seeking to maintain a competitive edge and deliver long-term value to their stakeholders.

References

Adams, C.A., 2020. Conceptualizing the Contemporary Corporate Value Creation Frameworks: Integrated Reporting and Beyond. Accounting Forum, 44(4), pp. 301-313.

Barnett, M.L. & Salomon, R.M., 2018. Beyond Dichotomy: The Curvilinear Relationship Between Social Responsibility and Financial Performance. Strategic Management Journal, 39(10), pp. 2338-2351.

Bhimani, A., Sivabalan, P. & Soonawalla, K., 2018. Management Accounting: Retrospect and Prospect. Journal of Management Accounting Research, 30(2), pp. 123-145.

Chiwamit, P., Modell, S. & Yang, C., 2020. The Effect of Institutional Pressures on Integrated Reporting and the Role of Financial Analysts. European Accounting Review, 29(3), pp. 437-466.

Christensen, H.B., Hail, L. & Leuz, C., 2020. Mandatory IFRS Reporting and Changes in Enforcement. Review of Accounting Studies, 25(2), pp. 101-132.

Donaldson, L., 2019. The Future of Corporate Reporting: Aligning Financial and Strategic Metrics. Management Accounting Quarterly, 31(1), pp. 79-96.

Eccles, R.G. & Klimenko, S., 2019. The Investor Revolution: Shareholders Are Getting Serious About Sustainability. Harvard Business Review, 97(3), pp. 106-116.

Epstein, M.J., 2018. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic Impacts. Journal of Corporate Accounting & Finance, 29(1), pp. 83-93.

Graham, J.R. & Harvey, C.R., 2019. How Do CFOs Make Capital Budgeting and Capital Structure Decisions?. Journal of Applied Corporate Finance, 31(1), pp. 8-23.

Hendriksen, E.S., 2020. Accounting Theory and Information Technology. Journal of Accounting Research, 18(3), pp. 102-120.

Jensen, M.C. & Meckling, W.H., 1976. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. Journal of Financial Economics, 3(4), pp. 305-360.

Kaplan, R.S. & Norton, D.P., 2020. Balanced Scorecard: Translating Strategy into Action. Harvard Business Review Press.

Kolk, A. & van Tulder, R., 2018. The Role of Sustainable Development in Corporate Strategy. Journal of Business Strategy, 39(3), pp. 92-99.

Moll, J. & Yigitbasioglu, O., 2019. The Role of Management Accounting in Digital Transformation. Management Accounting Research, 42, pp. 1-12.

Norton, D.P. & Kaplan, R.S., 2020. Using the Balanced Scorecard as a Strategic Management System. Harvard Business Review, 98(1), pp. 39-53.