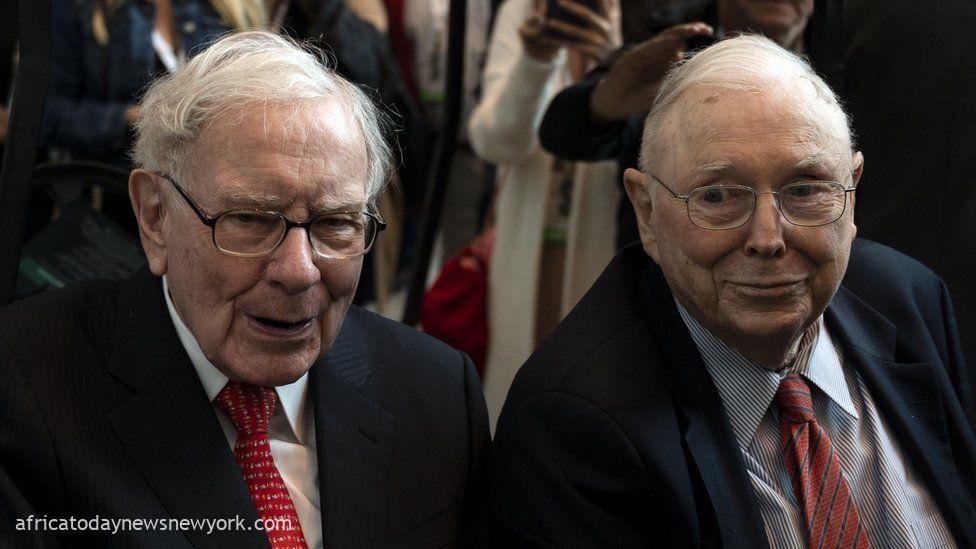

The investment world mourns the loss of Charlie Munger, who, alongside Warren Buffett, played a crucial role in the ascent of Berkshire Hathaway; he passed away at 99 in a California hospital.

Tuesday morning brought the sad announcement from Charlie Munger’s family to Berkshire Hathaway, revealing his passing at the hospital just a little over a month before his 100th birthday, as stated in the official release.

‘Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,’ Buffett said in a statement.

This year’s annual letter to Berkshire shareholders from the famed investor featured a special section dedicated to acknowledging the contributions of Charlie Munger.

Munger, as Berkshire’s longtime vice chairman, was instrumental in guiding the company alongside Buffett for more than five decades, offering invaluable insights on investments and business decisions.

Even though Munger had been using a wheelchair for mobility for several years, his mental acuity remained keen, showcased through lengthy question-and-answer sessions at this year’s annual meetings for Berkshire and the Daily Journal Corp., as well as in interviews with The Wall Street Journal, CNBC, and a notable investing podcast.

Munger, with a penchant for operating in the background, permitted Buffett to take the lead as the face of Berkshire, consistently downplaying his own substantial contributions to the company’s remarkable achievements.

Read also: Warren Buffett Heavily Scammed In Germany

However, Buffett always acknowledged Munger for pushing him beyond his early value investing tactics, encouraging the acquisition of outstanding businesses at favourable prices, exemplified by See’s Candy.

‘Charlie has taught me a lot about valuing businesses and about human nature,’ Buffett said in 2008.

Drawing from the wisdom of ex-Columbia University professor Ben Graham, Buffett’s early successes were based on acquiring stocks in companies undervalued in comparison to their assets, with subsequent sales as market prices increased.

Munger and Buffett initiated the acquisition of Berkshire Hathaway shares in 1962, securing them at $7 and $8 per share. By 1965, they had taken control of the New England textile mill.

Over time, the duo transformed Berkshire into the diversified conglomerate seen today, deploying profits from its enterprises to acquire entities such as Geico insurance and BNSF railroad. Concurrently, they maintained a prominent stock portfolio, featuring substantial investments in Apple and Coca-Cola. As of Tuesday, the shares have appreciated to $546,869, proving lucrative for investors who held onto their positions.

Preceding his 100th birthday, Munger participated in a comprehensive interview with CNBC earlier this month, and on Tuesday, the network aired snippets from that conversation. Using his trademark self-deprecating humour, Munger summarized Berkshire’s success by emphasizing the importance of avoiding mistakes and sustaining an active work ethic well into his and Buffett’s 90s.

‘We got a little less crazy than most people and a little less stupid than most people and that really helped us,’ Munger said.

In a special letter composed in 2014, commemorating half a century of his leadership at Berkshire, Munger provided a more detailed exploration of the reasons contributing to the company’s success.

While separated by a distance of more than 1,500 miles, Buffett and Munger, during their entire collaboration, upheld a close connection. Buffett routinely sought Munger’s advice, making calls to Los Angeles or Pasadena for consultation on every major decision.