Hong Kong stocks tumbled Tuesday after Moody’s downgraded the city’s credit rating over its response to months of sometimes violent protests, while other regional markets were also deep in the red following recent gains.

Observers warned of a growing concern about a SARS-like virus that has spread beyond China and which is now believed to be transmitted between humans.

With US markets closed for a holiday, traders struggled to find fresh catalysts to continue a long-running rally fuelled by the China-US trade pact, lowered Brexit tensions, central bank easing and an improving global outlook.

Hong Kong was the stand-out on Tuesday, plunging 1.8 percent a day after Moody’s said it had lowered its rating in a fresh blow to the financial hub, which is expected to have fallen into recession last year owing to the unrest as well as the China-US trade war.

In a statement, the firm said: “The absence of tangible plans to address either the political or economic and social concerns of the Hong Kong population that have come to the fore in the past nine months may reflect weaker inherent institutional capacity than Moody’s had previously assessed.”

The move comes as the business community grows increasingly worried the features that give Hong Kong more political and economic autonomy are weakening under pressure from Beijing.

Read Also: Canada Court Starts Extradition Hearing Of China Huawei

The decision came four months after a similar move by Fitch, which cited the demonstrations and uncertainty caused by closer integration with the Chinese mainland.

Among other markets, Tokyo ended the morning 0.8 percent lower, Shanghai was down 0.8 percent and Singapore sank more than one percent.

Sydney lost 0.4 percent, Seoul shed 0.5 percent and Manila was off 0.6 percent.

– China health alert –

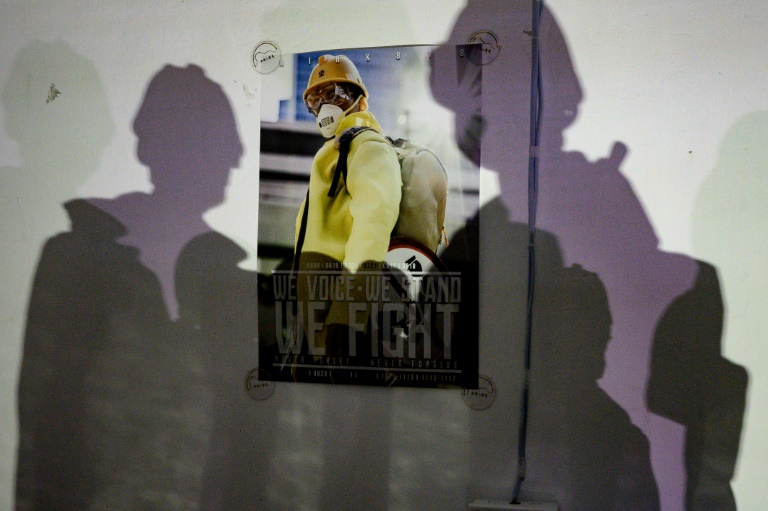

There is a growing unease about the spread of a virus from the Chinese city of Wuhan, which has now claimed four lives and sickened more than 200.

The new coronavirus strain has caused alarm because of its connection to Severe Acute Respiratory Syndrome (SARS), which killed nearly 650 people across mainland China and Hong Kong in 2002-2003.

It also comes as China prepares for the Lunar New Year holiday, which sees hundreds of millions of people travel across the country, with a top scientist at the country’s National Health Commission saying the virus has now been found to pass between humans.

The World Health Organization will meet Wednesday to determine whether to declare the outbreak “a public health emergency of international concern” — a rare designation only used for the gravest epidemics.

AxiCorp analyst Stephen Innes said the latest developments were “a building concern”.

“The cost to the global economy can be quite staggering in negative GDP terms if this outbreak reaches epidemic proportions as until this week, the market was underestimating the potential of the flu spreading,” he said in a note.

“But it’s an essential enough development that the market will continue to monitor on the risk radar, as if things turn critical it could provide a massive blow to the airline industry and a knockout punch to local tourism.”

The nervousness on trading floors saw investors shift out of higher-yielding, riskier currencies with the dollar up against the South Korean won, Australian dollar and Indonesian rupiah, among others.

But the greenback retreated against the safe-haven yen, while gold, another go-to asset in times of uncertainty, was also up.

While there is a general optimism that the world economic slowdown is easing, the International Monetary Fund said in its latest outlook report that it expected global growth to come in slightly weaker than previously forecast this year and next.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: DOWN 0.8 percent at 23,902.60 (break)

Hong Kong – Hang Seng: DOWN 1.8 percent at 28,271.30

Shanghai – Composite: DOWN 0.8 percent at 3,070.82

Euro/dollar: UP at $1.1091 from $1.1084 at 1645 GMT

Pound/dollar: UP at $1.2997 from $1.2996

Euro/pound: UP at 85.33 pence from 85.29 pence

Dollar/yen: DOWN at 110.00 yen from 110.16 yen

Brent Crude: UP 11 cents at $65.31 per barrel

West Texas Intermediate: UP 20 cents at $58.74

New York – CLOSED for public holiday

London – FTSE 100: DOWN 0.3 percent at 7,651.44 (close)

AFP