Bitcoin traders and investors have been warned to expect bitcoin volatility this weekend due to Lunar New Year celebrations in China.

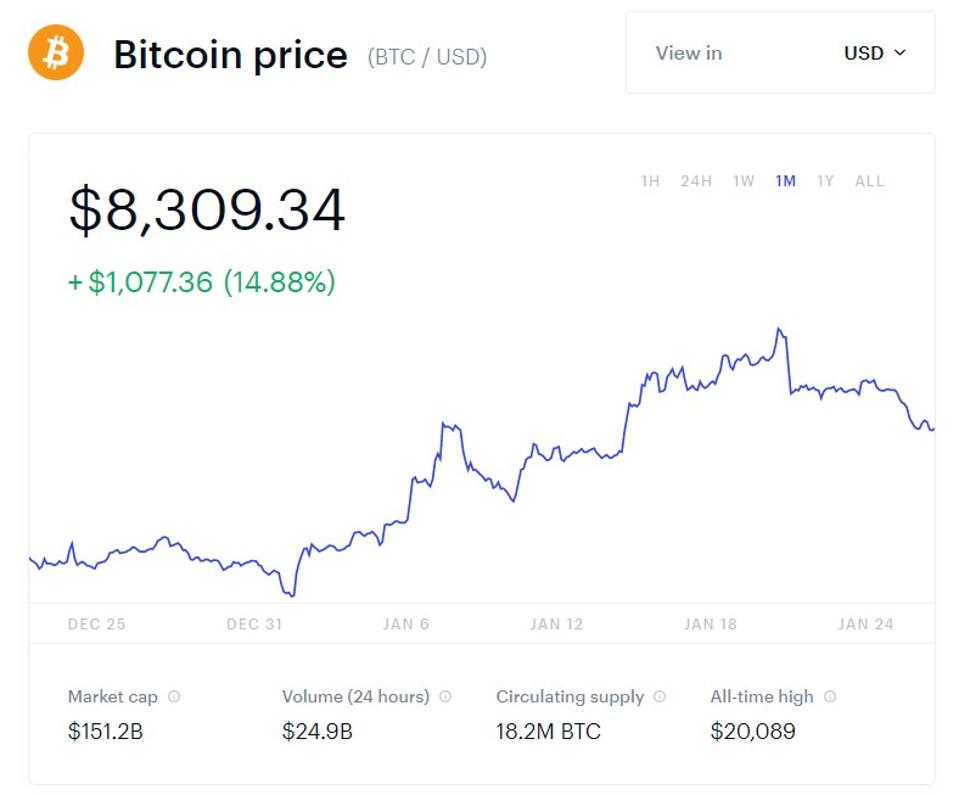

The bitcoin price has this week given up some of its early 2020 gains after climbing above $9,000 per bitcoin last weekend, dropping almost 10% over the last seven days—and falling further yesterday following a sharp change in bitcoin sentiment.

The Lunar New Year, also known as Spring Festival in China, falls on 25 January 2020, marking the … [+]

“The Year of the Rat starts this weekend. Time for bitcoin volatility and volumes to nose dive,” Arthur Hayes, the chief executive of the Seychelles-based bitcoin and cryptocurrency exchange Bitmex, said via Twitter.

Lunar New Year celebrations, expected to be somewhat muted due a coronavirus outbreak that’s killed at least 25 people in China and put many cities in the country on lock down, traditionally sees millions of people travel home for the weekend.

“Fireworks in store,” said Travis Kling, who runs Ikigai Asset Management, adding May’s looming bitcoin halving event, when the number of bitcoin rewarded to miners will be cut by half, will see “five years of trend lines perfecting coinciding with the most highly-anticipated event in bitcoin history.”

Earlier this month, crypto analysts warned bitcoin trading volume is now at its lowest since April, with volume down 90% from its June 2019 high—and when volume is low markets are more likely to make sudden, volatile moves.

Others are unconvinced the holiday will see a drop in volumes, however.

The bitcoin price has struggled with low volumes for some time.

COINBASE

“Some think the Chinese New Year may impact bitcoin negatively, as people sell bitcoin to purchase presents,” widely-respected economist and bitcoin commentator Alex Krüger said via Twitter earlier this month.

“Data indicates bitcoin does not under perform preceding the Chinese New Year,” Krüger said, adding the period has historically been “nothing special” for bitcoin volumes.

FORBES