Trefis analysis shows Tesla’s (NASDAQ: TSLA) stock could potentially drop to $0 from its current levels of over $500. We outline how Tesla could end up defaulting on its roughly $13 billion in debt, a meaningful portion of which matures over the next 4 years. What’s the trigger? We first consider the case of recession or a soft economy as a trigger to lower revenues, margins and a cash crunch. Then we highlight how there are other possible triggers that could lead to a similar set of events.

Below we discuss the specifics of Tesla Stock Downside included with our interactive charts to test sensitivity to underlying assumptions. Deeper insights on Tesla Revenues and Tesla expenses as well as Tesla P/S multiple, are also available separately as context to this analysis. Additionally, we provide a counter analysis to our Tesla downside case in our interactive dashboard for Tesla Stock Upside: $2,000?

Read Also: How To Run A Startup Part-Time Without Working Over Time

#1. Tesla’s Revenues could decline over 35% between 2020 and 2022, falling from $32 billion to $21 billion, in the event of a recession

- As we’ve seen during the 2008 recession, luxury vehicle deliveries can take a significant hit.

- For instance Lexus sales fell 35% between 2007 and 2009.

- Considering this, Tesla deliveries could fall from about 495k units in 2020 to 316k units in 2022.

- ASPs could also decline from about $56k to $52k, as Tesla may have to resort to discounts to sell its cars during a downturn.

- This could cause revenues to decline from roughly $32 billion to $21 billion between 2020 and 2022.

We analyze and compare Tesla deliveries with BMW and other luxury car-makers, to paint a broader picture.

#2. Tesla’s Gross Profits could decline from over $6 billion in 2020 to about $3.6 billion by 2022

- Tesla’s gross margins could decline from 21% in 2021 to 18% in 2023 due to lower ASPs and deliveries.

- This would cause gross profits to decline from $6.4 billion in 2020 to $3.9 billion in 2022.

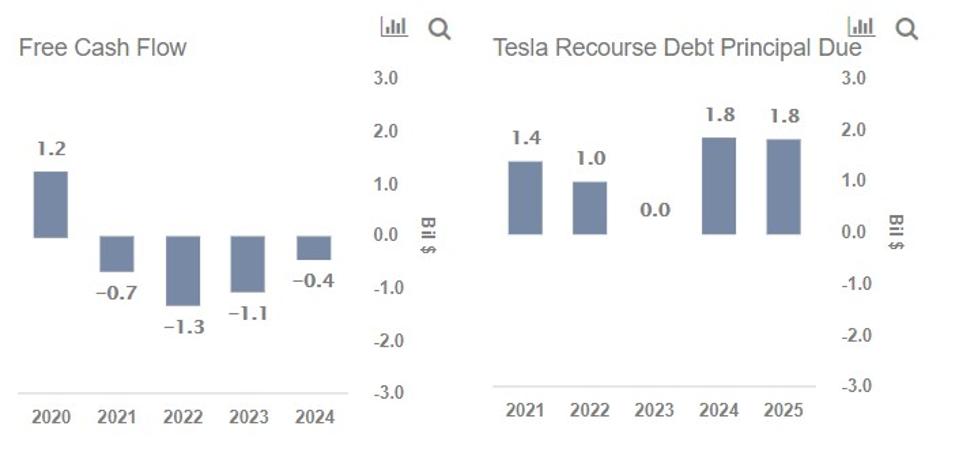

#3. Tesla’s Free Cash Flows could turn negative again

- In this case, Tesla could go from generating $1.2 billion in free cash flows in 2020 to burning $1.9 billion in cash in 2022.

For more details on Tesla’s free cash flows, view our dashboard analysis about Tesla Stock Downside

#4. The negative cash flows could hurt the company’s ability to service its debts when they come due

- Tesla has $2.4 billion in bonds that mature between 2021 and 2023 as well as a credit agreement of $1.8 billion that matures between 2020 and 2023 (not shown in chart). This adds up to at least $4.2 billion in debt payments between 2021-2023, not accounting for smaller non-recourse payments.

- Separately, in the event of a recession, the company could burn through over $3.1 billion in cash between 2021 and 2023, as shown in the charts below.

- While Tesla has $5.8 billion in cash currently, with the number likely to grow to $7 billion by the end of 2020, the cash burn and debt payments due over 2021 and 2022 could cause the company to run low on cash by 2023.

- This could be an issue, as about $3.6 billion in debt payments come due over 2024 and 2025.

Recession the only possible trigger? No – there are other risks

The above events leading to Tesla default can be triggered by many types of risks. We outline some below

- Increase in accident rate: While currently considered one of the safest, glitches in self-driving auto-pilot technology or fires related to battery packs can trigger negative publicity and loss of consumer confidence resulting in a sharp drop in deliveries.

- Escalation of the U.S. trade war with China: This could hurt the company’s prospects in the growing market. China is a key market for Tesla at this time.

- Succession and corporate governance issues: Tesla’s fortunes have remained heavily tied to CEO Elon Musk, who has a track record of being unpredictable and combative. Tesla might fall victim to its own creator’s follies.

If the company were to face one or more of these issues independently or alongside a recession, it’s possible that financing could dry up for Tesla at the time when it has to pay its debts.

Tesla’s stock has a track record of reacting very strongly to news

- Between December 2018 and May 2019, Tesla stock declined by about 50%, on account of weaker-than-expected earnings and deliveries.

- Events such as a default could significantly hurt the stock price, potentially wiping out much of Tesla’s value as we detail in our interactive dashboard, synthesized along with a range of Trefis research, including Tesla’s battery cost analysis, to self-driving business potential, and all our Tesla analysis.

FORBES